401 K Contribution Limit 2024 Catch Up

401 K Contribution Limit 2024 Catch Up. You can contribute to more than one 401 (k). In 2024, you’re able to contribute.

In 2024, you can contribute $23,000 to a roth 401(k). This is on top of the standard contribution limit of $22,500.

The 401 (K) Compensation Limit.

Employees can contribute up to $23,000 to their 401 (k) plan for 2024 vs.

For Those With A 401 (K), 403 (B), Or 457 Plan Through An Employer, Your New Maximum Contribution Limit Will Go Up To $23,000 In 2024.

For 2024, the employee contribution limit for 401 (k) plans is $23,000, up from $22,500 in 2023.

401 (K) Contribution Limits For 2024.

Images References :

Source: karnaqbrandice.pages.dev

Source: karnaqbrandice.pages.dev

401k Maximum Salary 2024 Nonah Annabela, Employees can invest more money into 401 (k) plans in 2024, with contribution limits increasing from 2023’s $22,500 to $23,000 for 2024. Those 50 and older can.

Source: eddyqrochell.pages.dev

Source: eddyqrochell.pages.dev

Irs Comp Limit 2024 Ulla Alexina, Starting in 2026, though, 50. This is on top of the standard contribution limit of $22,500.

Source: q2023i.blogspot.com

Source: q2023i.blogspot.com

401k 2023 Contribution Limit Irs Q2023I, You can contribute to more than one 401 (k). Starting in 2026, though, 50.

Source: www.aiohotzgirl.com

Source: www.aiohotzgirl.com

2023 Retirement Plan Contribution Limits 401 K Ira Roth Ira Free, For those with a 401 (k), 403 (b), or 457 plan through an employer, your new maximum contribution limit will go up to $23,000 in 2024. Fact checked by jiwon ma.

Source: www.hanovermortgages.com

Source: www.hanovermortgages.com

Whatâ s the Maximum 401k Contribution Limit in 2022? Hanover Mortgages, Employees can invest more money into 401 (k) plans in 2024, with contribution limits increasing from 2023’s $22,500 to $23,000 for 2024. Total 401 (k) plan contributions by an employee and an employer cannot exceed $69,000 in 2024.

Source: madelynwalisa.pages.dev

Source: madelynwalisa.pages.dev

401 Contribution Limits 2024 Over 50 Daron Emelita, In 2024, you can contribute $23,000 to a roth 401(k). For 2024, the 401(k) annual contribution limit is $23,000, up from $22,500 in 2023.

Source: meldfinancial.com

Source: meldfinancial.com

401(k) Contribution Limits in 2023 Meld Financial, 401 (k) contribution limits for 2024. You used a health savings.

Source: choosegoldira.com

Source: choosegoldira.com

401k 2022 contribution limit chart Choosing Your Gold IRA, The limit for overall contributions—including the employer match—is 100%. In 2024, you’re able to contribute.

Source: westfincorp.com

Source: westfincorp.com

IRS These are your 401(k) and IRA contribution limits for 2023, This amount is an increase of. The limit on employer and employee contributions is $69,000.

Source: stopbeingsold.com

Source: stopbeingsold.com

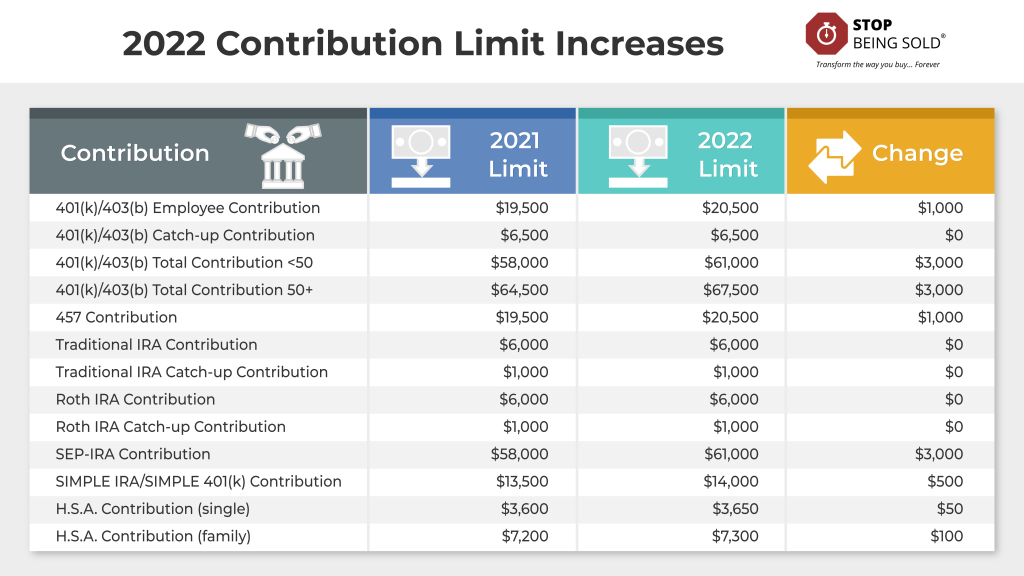

2022 Retirement Plan Contribution Limits Stop Being Sold, For those with a 401 (k), 403 (b), or 457 plan through an employer, your new maximum contribution limit will go up to $23,000 in 2024. Workers ages 50 and older have a higher annual 401 (k) contribution limit than their younger peers.

This Is On Top Of The Standard Contribution Limit Of $22,500.

For those with a 401 (k), 403 (b), or 457 plan through an employer, your new maximum contribution limit will go up to $23,000 in 2024.

This Amount Is An Increase Of.

Fact checked by jiwon ma.